Why Your Financial Security Depends on Understanding Uninsured Motorist Claims

An uninsured motorist claim is filed with your own insurer when you’re in an accident with a driver who has no insurance or not enough to cover your damages. This coverage can help pay for medical bills, lost wages, pain and suffering, and property damage when the at-fault driver cannot.

How to File an Uninsured Motorist Claim:

- Ensure safety and call 911 if anyone is injured

- Document the scene with photos and gather driver information

- Obtain a police report to establish an official record

- Notify your insurance company immediately about the accident

- Provide evidence including medical records, bills, and lost wage documentation

- Cooperate with your adjuster during the investigation

- Negotiate settlement or seek legal help if the offer is too low

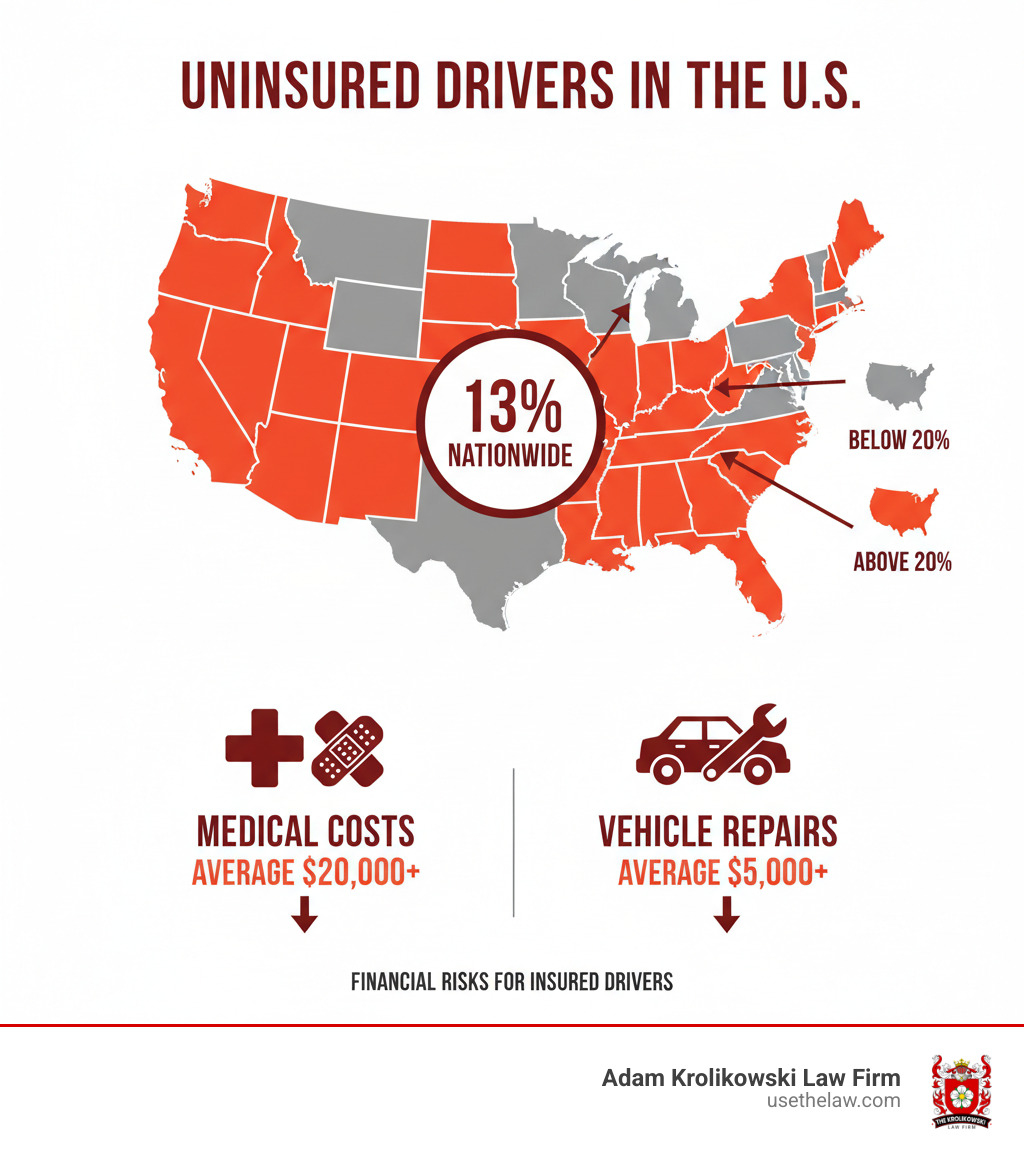

With nearly 13% of U.S. drivers uninsured (and over 20% in some states), your risk of being hit by one is high. When that happens, you could be left with medical bills, lost wages, and car repair costs with no one to pay for them.

Uninsured motorist coverage is your financial safety net, allowing you to recover losses from your own policy instead of suing a driver with no assets. However, the claims process can be challenging. Insurers might deny, delay, or underpay claims. Understanding your rights, what to document, and when to seek legal help is key to receiving fair compensation.

This guide walks you through every step of filing an uninsured motorist claim, from actions at the scene to negotiating with adjusters and knowing when legal guidance is necessary.

Uninsured motorist claim terminology:

- personal injury lawyer orange county

- Santa Ana DUI accident lawyer

- santa ana trucking accidents attorney

Understanding Uninsured (UM) and Underinsured (UIM) Motorist Coverage

Imagine getting into an accident, only to find the other driver has no insurance, or not enough to cover your bills. This is where Uninsured Motorist (UM) and Underinsured Motorist (UIM) coverage become your financial lifeline.

Uninsured Motorist (UM) Coverage protects you when the at-fault driver has no liability insurance. It acts as your safety net, covering your expenses.

Underinsured Motorist (UIM) Coverage applies when the at-fault driver has insurance, but their policy limits are too low to cover your full damages. Your UIM coverage can bridge the gap, up to your policy limits.

Most UM/UIM policies include two parts. Bodily Injury (UMBI/UIMBI) covers medical bills, lost wages, and pain and suffering. Property Damage (UMPD/UIMPD) helps pay to repair or replace your vehicle.

This coverage is critical in several scenarios, including hit-and-run accidents, collisions with an at-fault driver with no insurance, and accidents with an at-fault driver with insufficient insurance.

Here’s how UM/UIM compares to other common coverages:

| Coverage Type | What it Covers | When it Applies |

|---|---|---|

| Uninsured/Underinsured Motorist | Medical bills, lost wages, pain and suffering, property damage (depending on policy/state) for your losses. | When the at-fault driver has no insurance (UM) or not enough insurance (UIM). |

| Collision | Damage to your vehicle. | When your car collides with another vehicle or object, regardless of who is at fault. |

| Medical Payments (MedPay)/PIP | Medical expenses for you and your passengers. | After an accident, regardless of who is at fault. Does not cover lost wages or pain and suffering. |

What Damages Can Be Covered?

When you file an uninsured motorist claim, your UM/UIM coverage is designed to address the wide-ranging financial impact of the accident.

- Medical bills: Covers everything from ambulance rides and ER visits to hospital stays, physical therapy, and ongoing care.

- Lost wages: Compensates you for lost income during your recovery, including base salary, overtime, and bonuses.

- Pain and suffering: Acknowledges the physical and emotional toll of the accident, such as chronic pain or a diminished quality of life.

- Property damage: Helps repair or replace your vehicle.

- Funeral costs: Can be covered through UMBI/UIMBI in the most tragic circumstances.

This coverage exists to protect your financial stability from another driver’s irresponsibility.

State Requirements, Deductibles, and Policy Limits

Auto insurance rules vary significantly by state. Some states mandate UM/UIM coverage, while others make it optional. Given that nearly 13% of drivers are uninsured, our team at Adam Krolikowski Law Firm strongly recommends carrying it regardless of state law. For more details, see this resource: Background on Compulsory Auto/Uninsured Motorists.

For example, South Carolina requires UM coverage equal to the minimum liability amounts (25/50/25), while UIM is optional. California has its own specific regulations. It’s crucial to understand your state’s minimums and consider purchasing higher limits for better protection.

Deductibles also vary. Bodily injury (UMBI/UIMBI) claims typically have no deductible. Property damage (UMPD/UIMPD) claims often have a deductible of around $200 to $500.

When choosing coverage limits, a good rule of thumb is to match them to your liability coverage limits. This ensures you have adequate protection if you’re hit by someone who can’t pay for the damage they cause.

First Steps After an Accident with an Uninsured Driver

The moments after an accident are chaotic, but what you do next can make or break your uninsured motorist claim.

First, ensure safety. Check yourself and your passengers for injuries. Some injuries, like whiplash, may not be immediately apparent. Call 911 if anyone is hurt, the vehicles are blocking traffic, or the other driver seems uncooperative or impaired.

Next, exchange information. Even if the other driver is uninsured, get their name, address, phone number, driver’s license number, and license plate. Note the vehicle’s make and model. Be thorough, as some uninsured drivers may provide false information.

Then, document everything. Use your phone to take photos and videos of the accident scene, damage to both vehicles, and any visible injuries. Capture skid marks, road conditions, and traffic signs. Get a clear photo of the other driver’s license plate.

If there were witnesses, seek witness statements. Politely ask for their names and contact information. Independent accounts can significantly strengthen your uninsured motorist claim.

Finally, avoid roadside deals. An uninsured driver might offer cash to avoid reporting the accident. This is almost always a bad idea, as it will likely leave you with unpaid bills and no legal recourse. Always report the accident through official channels.

The Critical Role of a Police Report

A police report is the foundation of your uninsured motorist claim. It serves as the official accident record, providing an impartial account that insurance companies trust.

The report is crucial for proving fault. An officer’s assessment of who caused the accident carries significant weight with your insurer. It also provides validation of the other driver’s uninsured status, which is necessary to trigger your UM coverage.

For hit-and-run claims, a police report is mandatory. Your insurer will require it to verify that the incident occurred and the at-fault driver is unknown. Without it, your claim will likely be denied.

To obtain a copy, contact the law enforcement agency that responded to the accident. There is usually a small fee, and some agencies offer online access. Provide a copy to your insurance company when you file your claim.

The Uninsured Motorist Claim Process: A Step-by-Step Guide

After handling the immediate aftermath, the next step is navigating the uninsured motorist claim process with your insurer. Understanding the process makes it more manageable.

Claim timelines vary. Simple property damage claims may resolve in weeks, but cases with significant injuries can take several months or longer. Complex cases require more time to document all damages fully.

Cooperation with your adjuster is crucial. The adjuster investigates and evaluates your claim, and they need your help. Respond promptly to requests and provide all necessary documentation to keep your claim moving smoothly.

Proving your damages relies on the evidence you gathered. Photos, medical records, bills, and wage statements demonstrate the full extent of your physical and financial losses.

How to Initiate Your Uninsured Motorist Claim

Notify your insurance company as soon as possible after the accident. Delays can complicate or even jeopardize your claim.

When you call, have your policy number ready. Explain the situation clearly, describing what happened and stating that the other driver was uninsured or underinsured. Your insurer will then initiate your claim and assign an adjuster to your case.

It’s important to understand your insurer’s role. When you file an uninsured motorist claim, your insurance company essentially steps into the shoes of the at-fault driver’s insurer. They will investigate fault and evaluate your damages before determining a settlement. While it may feel odd to be investigated by your own insurer, this is standard for UM/UIM claims.

The Investigation and Settlement Phase

Your insurer will need to verify all details of the accident.

Determining fault is a primary step. Your insurer will review the police report, witness statements, and photos to confirm the other driver was responsible. In many states, the other driver must be found at fault for your UM/UIM coverage to apply.

Your insurer will also work on validating the other driver’s insurance status by checking state databases or contacting the driver directly.

For bodily injury claims, you must submit all medical records and bills. Keep meticulous records of every visit, test, and prescription. To claim lost wages, provide pay stubs, a letter from your employer, and a doctor’s note confirming your inability to work.

Once damages are evaluated, the negotiation begins. Your insurer will make an initial settlement offer. This first offer is often not the final one and may not reflect your claim’s full value. If you disagree with the offer, you can continue negotiating, present more evidence, or seek legal help. If negotiations stall or the offer is unreasonably low, consulting with a personal injury attorney is a wise next step.

Common Concerns and When to Seek Legal Help

Filing an uninsured motorist claim with your own insurer isn’t always easy. Insurance companies are businesses focused on their bottom line, which can sometimes lead to challenges in the claims process.

You may encounter claim denials, delays, or lowball offers that don’t cover your actual damages. Your insurer might dispute fault or question the severity of your injuries. These tactics are frustrating and can stall the compensation you need.

If your injuries are complex or severe, calculating the true value of your claim becomes more difficult. You must account for future medical costs, lost earning capacity, and the lasting impact on your quality of life. These are not simple calculations.

If you face any of these challenges, or if your injuries are significant, consider seeking legal help. At Adam Krolikowski Law Firm, we handle complex cases and understand the tactics insurance companies use. Having an attorney can change how seriously your claim is taken. For difficult injury cases or disputes with your insurer, learn more about how a personal injury lawyer can help.

Will Filing an Uninsured Motorist Claim Affect My Insurance Rates?

This is a common worry, but the news is generally good. In most states, laws provide protections for not-at-fault accidents. For example, Georgia’s O.C.G.A. § 33-9-40 prohibits insurers from raising rates for a multi-vehicle accident where you weren’t at fault. You can read more here: Georgia law on nonrenewal of auto policies.

However, insurance laws vary by state. While a not-at-fault UM claim shouldn’t directly cause a rate hike, some states allow insurers to review your overall claims history, which could affect discounts. The fear of policy cancellation or non-renewal is also real. While laws offer protection, some policies have provisions about the number of claims filed within a certain period.

Our advice: don’t let fear stop you from using the coverage you pay for. If you’re concerned, talk to your agent about your policy and state laws. You have protections—don’t be afraid to use them.

What If I Don’t Have UM/UIM Coverage?

If you’re hit by an uninsured driver and lack UM/UIM coverage, your options are limited and often costly. The financial burden for your losses could fall entirely on you.

Your main option is to sue the at-fault driver directly. However, collecting payment is difficult, as people who drive without insurance often lack significant assets. Even if you win a judgment, you may never see the money.

Your health insurance can help with medical bills, but it won’t cover lost wages or pain and suffering. You’ll still be responsible for deductibles and co-pays. If you have collision coverage, it will pay for your vehicle damage (minus your deductible), but nothing else.

This difficult scenario highlights why UM/UIM coverage is so vital. It’s an investment in your financial security. If you don’t have it, now is the time to add it to your policy. For more information, you can read What To Do if Hit by an Uninsured Driver.

Frequently Asked Questions about Uninsured Motorist Claims

Here are answers to some of the most common questions about uninsured motorist claims.

What is the difference between Uninsured Motorist Bodily Injury (UMBI) and Medical Payments (MedPay) coverage?

The key difference is how and when they apply.

- Uninsured Motorist Bodily Injury (UMBI) is fault-based. It applies only when an uninsured or underinsured driver is at fault. It is comprehensive, covering medical bills, lost wages, and pain and suffering.

- Medical Payments (MedPay) is no-fault coverage. It pays for your medical and funeral expenses up to your policy limit, regardless of who caused the accident. It does not cover lost wages or pain and suffering.

Think of MedPay as a first-aid kit for immediate medical costs, while UMBI is a full protection plan for when an uninsured driver is at fault.

How long does an uninsured motorist claim typically take to resolve?

The timeline varies. A simple property damage claim might be resolved in a few weeks. However, claims involving significant bodily injuries can take several months or even longer. The process depends on the severity of your injuries, the complexity of the investigation, and the negotiation process.

Does UM coverage apply if I was a pedestrian or on a bicycle?

Yes, in most cases. This is a feature many people are unaware of. Your auto insurance policy’s UM coverage generally extends to protect you and resident family members if you are hit by an uninsured driver while walking, jogging, or cycling. It acts as a personal injury safety net that follows you, not just your vehicle. It’s always a good idea to review your specific policy language to confirm the details.

Conclusion

Understanding how uninsured motorist claims work empowers you to steer the process with confidence and protect your financial future. This coverage is your lifeline when an irresponsible driver leaves you with medical bills, lost wages, and vehicle damage.

You’ve learned the critical first steps at an accident scene, how to initiate a claim, and what evidence you need to build a strong case. We’ve also addressed common concerns, like the impact on your insurance rates and what to do if you lack coverage.

Most importantly, you don’t have to steer this alone. While some claims are straightforward, you may need support if your injuries are severe or your insurance company is using delay tactics or making lowball offers.

At Adam Krolikowski Law Firm, we have over 25 years of experience helping people hit by uninsured drivers. We handle the complex cases that other attorneys may hesitate to take on because we know what it takes to fight for the compensation you deserve.

If you’re struggling with a complicated uninsured motorist claim or are at odds with your insurer, reach out to us. We can review your situation and help you decide on the best path forward. Your financial recovery is too important to leave to chance. Learn more about how a personal injury lawyer can help you get the compensation you deserve.