Why Understanding Car Damage from Pedestrian Collisions Matters

Car damage from hitting pedestrian collisions can range from minor bumper dents to extensive hood and windshield damage, depending on impact speed and pedestrian trajectory. Here’s what drivers need to know immediately:

Common Vehicle Damage Types:

- Bumper deformation – Most frequent damage point

- Hood denting – From pedestrian body contact

- Windshield cracks – Impact or trajectory damage

- Headlight/mirror damage – Side impact zones

- Fender scratches – Glancing contact

Insurance Coverage:

- Collision coverage pays for your vehicle repairs

- Liability coverage pays for pedestrian injuries/property

- Comprehensive does NOT cover pedestrian collision damage

Immediate Actions Required:

- Stop immediately (hit-and-run is criminal)

- Call 911 for injuries

- Document scene and damage

- Notify insurer within 30 days

The physics of pedestrian collisions create unique damage patterns. Unlike car-to-car crashes, the significant mass difference between vehicles and pedestrians means your car absorbs most impact energy. Research shows that approximately 75% of pedestrian impacts happen at speeds of 25 mph or less, yet even low-speed collisions can cause thousands in vehicle damage.

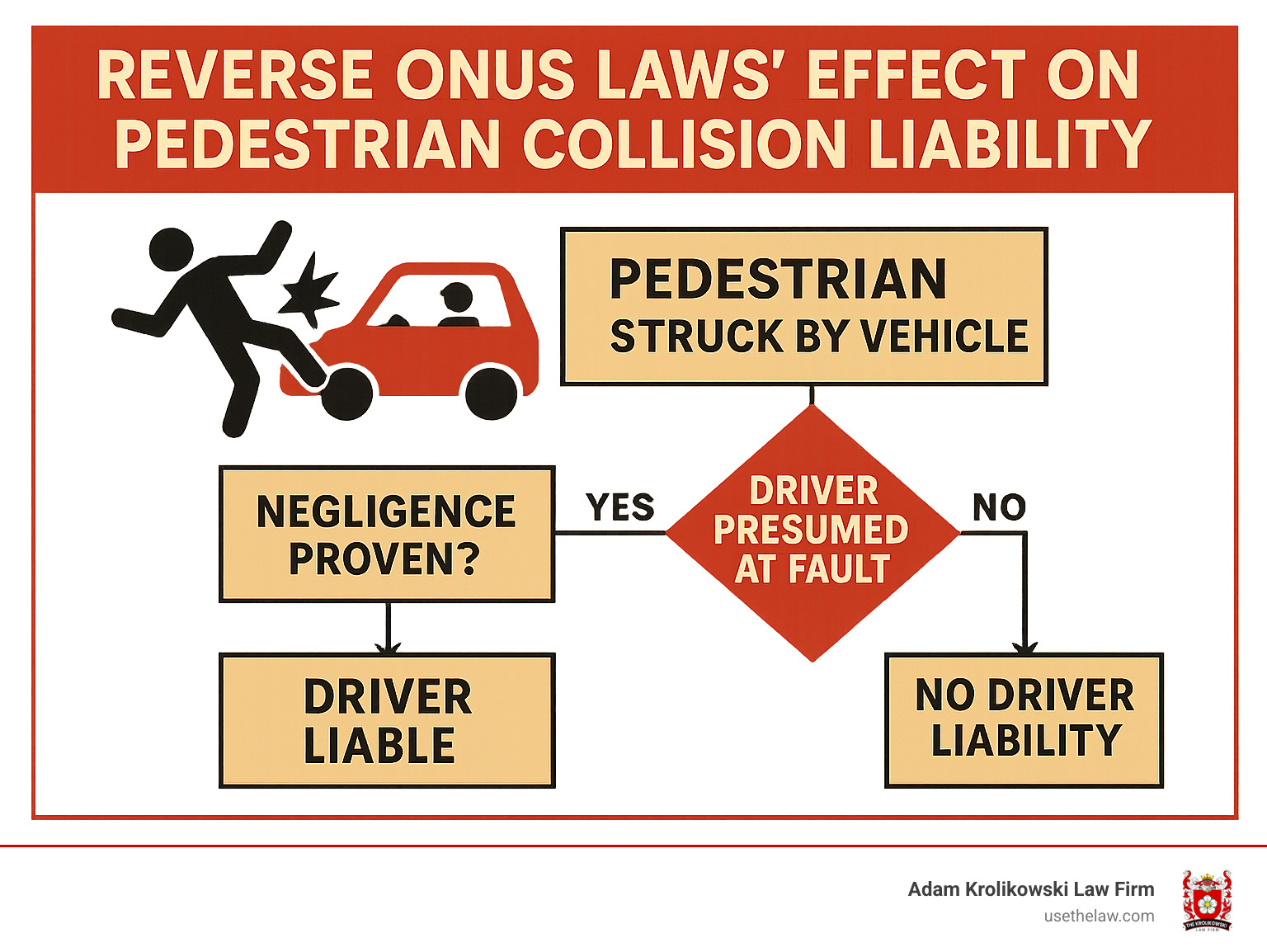

In Ontario, drivers face a “reverse onus” – you’re presumed at fault unless proven otherwise. This legal reality makes proper documentation crucial for both injury claims and vehicle damage recovery.

Car damage from hitting pedestrian glossary:

First Five Minutes: Safety and Documentation

When you’ve just hit a pedestrian, your heart is racing and your mind is spinning. Those first five minutes feel like hours, but what you do right now will determine everything that follows – from the pedestrian’s recovery to your legal protection and whether your insurance covers the car damage from hitting pedestrian.

Stop immediately – this might seem obvious, but shock can make drivers do strange things. Even if the damage looks minor or the pedestrian walks away, leaving the scene is a crime. Turn on your hazard lights and move your vehicle out of traffic if it’s safe to do so.

Check for injuries without moving the pedestrian. They might seem fine at first, but adrenaline can mask serious injuries. Call 911 right away – this isn’t optional. Most states and provinces require police reports for pedestrian collisions.

Secure the scene if you can do it safely. Use flares or warning triangles if you have them.

Now comes the documentation that will protect you later. Take photos of your vehicle damage from every angle – front, back, sides, and close-ups of dents, scratches, and broken parts. Photograph the scene overview showing where the impact happened and where the pedestrian ended up.

Get witness information – names, phone numbers, and brief statements about what they saw. Don’t let witnesses leave without getting their contact details.

Exchange information with the pedestrian if they’re conscious and able. You need their name, address, and phone number, just like in any collision. Give them your driver’s license, insurance information, and contact details.

In Ontario and many U.S. states, hit-and-run laws apply regardless of who was at fault. The Criminal Code of Canada makes leaving a collision scene a serious offense, with penalties including license suspension and jail time.

Protect Your Claim from the Start

Insurance adjusters move fast after pedestrian collisions. They’ll often arrive within hours to measure skid marks, document vehicle positions, and interview witnesses. What you preserve in these first minutes can mean the difference between full coverage and paying thousands out of pocket.

Tire friction marks tell the story of your braking and speed. Vehicle rest positions show the impact dynamics. Pedestrian throw distance correlates directly to impact speed – information that affects both fault determination and your insurance rates.

Document traffic control devices like signals, signs, and crosswalk markings. Note the weather and lighting conditions too.

The Role of Medical Evidence in Car Accident Claims becomes crucial when insurers investigate fault and coverage decisions.

Don’t discuss fault with anyone except police and your attorney. Statements like “I didn’t see them” or “They came out of nowhere” feel natural in the moment, but they can be used against you later.

Reverse onus laws in Ontario mean you’re presumed at fault unless proven otherwise. This legal reality makes proper documentation your lifeline.

Understanding Car Damage from Hitting a Pedestrian

When you’re dealing with car damage from hitting pedestrian incidents, the damage patterns are completely different from regular car crashes. It’s not just about bent metal – it’s about understanding how physics works when a 3,000-pound vehicle meets a 150-pound person.

In a car-to-car crash, both vehicles absorb some impact. But when you hit a pedestrian, your car takes almost all the damage. The person bounces off, and your vehicle bears the brunt of the force.

The collision happens in three stages. First, your bumper hits the pedestrian’s legs or hips. Then, their body rolls onto your hood and possibly your windshield. Finally, they slide or bounce off onto the ground. Each stage creates different types of damage to your vehicle.

Common Impact Zones and Typical Repairs

Your bumper usually takes the first hit. Modern bumpers aren’t just plastic covers – they’re complex systems with sensors, cameras, and mounting brackets. Even a low-speed impact can crack the bumper cover, damage parking sensors, or bend the metal reinforcement bar underneath.

Bumper repairs range from $1,500 for simple plastic replacement to over $4,000 when the impact damages the car’s safety sensors or computer systems.

Hood and windshield damage comes next. When the pedestrian’s body hits your hood, it creates dents that often can’t be repaired – the whole hood needs replacing. If they slide up onto your windshield, you’re looking at cracks or complete windshield replacement.

Windshield damage from hitting pedestrian impacts often looks minor at first but spreads quickly. Hood damage combined with windshield replacement typically runs $2,000 to $6,000, depending on your car’s make and model.

Headlights and mirrors get damaged too. Side impacts or glancing blows often take out side mirrors completely. Modern LED headlight assemblies are expensive – sometimes over $1,000 each to replace.

How “car damage from hitting pedestrian” differs from other crashes

Here’s what makes pedestrian collisions unique: there’s no other crumple zone to share the impact. When two cars crash, both vehicles absorb energy through their designed crumple zones. But a human body doesn’t have crumple zones – it’s your car that has to absorb all that energy.

This creates unpredictable damage patterns. Car-to-car crashes happen at predictable heights and angles. But pedestrians are different heights, and they move in unexpected ways during impact.

Your airbags might deploy even in low-speed pedestrian crashes. This happens because the impact sensors detect the sudden deceleration, even though the collision might not seem severe. Airbag replacement alone can cost $2,000 to $4,000.

Speed, Angle & Throw Distance: Predicting Repair Costs

Scientific research on pedestrian throw distance shows a clear connection between impact speed and how far the pedestrian travels. This matters for your repair costs because faster impacts create more damage.

At speeds under 15 mph, you’re usually looking at bumper damage and minor hood denting. The pedestrian typically doesn’t travel far, and the damage stays in the front of your vehicle.

Between 15 and 25 mph, the damage gets more serious. The pedestrian’s body hits your hood harder and might crack your windshield. You’re looking at more extensive repairs that can easily reach $5,000 or more.

Over 25 mph, the damage becomes severe. The pedestrian might hit your windshield hard enough to cave it in or even contact your roof. These high-speed impacts can cause structural damage that totals your vehicle.

The angle matters too. A straight-on impact creates different damage than a glancing blow. Insurance adjusters use these patterns to estimate repair costs. Low-speed impacts average $2,000 to $5,000 in repairs, while high-speed collisions can exceed $15,000, especially on luxury vehicles with advanced safety systems.

Insurance Coverage: Who Pays for Vehicle Repairs?

Understanding which coverage applies to car damage from hitting pedestrian can save you thousands in out-of-pocket costs. Coverage confusion remains the most common source of claim disputes.

Coverage Breakdown:

| Coverage Type | Covers Vehicle Damage | Covers Pedestrian Injuries | Deductible Applies |

|---|---|---|---|

| Collision | Yes | No | Yes |

| Liability | No | Yes | No |

| Comprehensive | No* | No | Yes |

*Comprehensive specifically excludes collision damage, including pedestrian impacts

Mandatory Minimums by Region:

- Ontario: $200,000 third-party liability minimum

- California: $15,000 bodily injury per person minimum

- Most provinces: 98% of drivers carry $1,000,000+ liability limits

Will “Car Damage from Hitting Pedestrian” be Paid by My Policy?

Collision Coverage Requirements:

Your collision coverage pays for vehicle repairs regardless of fault, minus your deductible. This coverage is optional in most jurisdictions but essential for pedestrian collision protection.

At-Fault Status Impact:

- At-fault determination – Affects future premiums but not current claim payment

- Subrogation rights – Your insurer may pursue pedestrian if they’re at fault

- Deductible recovery – Possible if pedestrian found liable

Claim Type Considerations:

Pedestrian collisions typically file as collision claims, not liability claims. This distinction matters because:

- Collision coverage has higher deductibles ($500-$1,000 typical)

- Liability coverage pays others’ damages, not your vehicle

- Accident benefits cover medical expenses for all parties

Collision vs Liability vs Comprehensive

Collision Coverage Scope:

- Covers all collision damage – Including pedestrian impacts

- Applies regardless of fault – You’re covered even if pedestrian was jaywalking

- Includes rental car coverage – Often during repairs

- Deductible applies – Typically $500-$1,000

Liability Coverage Scope:

- Covers pedestrian injuries – Medical bills, lost wages, pain and suffering

- Property damage – Pedestrian’s belongings, not your vehicle

- Legal defense costs – If sued by injured pedestrian

- No deductible – Insurer pays full amount up to policy limits

Comprehensive Exclusions:

Despite its name, comprehensive coverage specifically excludes collision damage. It covers:

- Theft and vandalism – Not collision-related

- Weather damage – Hail, flooding, etc.

- Animal strikes – But not pedestrian impacts

- Glass coverage – May have separate deductible

Cyclist vs Pedestrian Similarities:

Insurance treats cyclist and pedestrian collisions identically. Both require collision coverage for vehicle damage and trigger liability coverage for injuries.

Navigating the Claim Process and Controlling Costs

The claim process for car damage from hitting pedestrian collisions can feel overwhelming, especially when you’re already dealing with the emotional impact of the accident. Understanding your rights and the insurance process can save you thousands of dollars.

Time is critical when filing your claim. Most insurance policies require you to report accidents within 30 days, though it’s always better to call sooner rather than later.

Don’t let your insurer pressure you into using their “preferred” repair shop. While these shops might offer convenience, you have the right to choose where your car gets fixed. This choice can significantly impact both the quality of repairs and your out-of-pocket costs.

OEM parts versus aftermarket parts represent one of the biggest cost decisions you’ll face. Original equipment manufacturer parts typically cost 20-30% more than aftermarket alternatives, but they often come with better warranties and guaranteed fit.

Rental car coverage becomes a lifesaver when your vehicle needs extensive repairs. Most collision coverage includes rental benefits, typically ranging from $30-$50 per day.

Evidence Insurers Look For

Insurance adjusters approach pedestrian collision claims with a methodical eye, looking for specific types of evidence that help them understand what really happened.

Scene measurements tell the story of your accident. Adjusters measure skid mark length to estimate your speed before impact, examine the pedestrian’s rest position to calculate throw distance, and identify the point of impact to understand right-of-way issues.

Modern technology provides adjusters with increasingly sophisticated evidence. Telematics data from your vehicle can show your exact speed, braking patterns, and acceleration in the moments before impact. Traffic cameras are becoming more common in urban areas, providing objective video evidence of accidents.

Witness statements and driver accounts get compared for consistency. The police report carries significant weight, though it’s not always the final word on fault determination.

When evidence disputes arise or fault determination affects your coverage, Personal Injury Law Attorney Help After an Accident becomes crucial for protecting your interests.

When You Lack Collision Coverage

Not having collision coverage doesn’t mean you’re completely out of luck for vehicle damage recovery, though your options become more limited and challenging.

Small claims court offers one avenue for recovery if the pedestrian was at fault. You can sue directly for your vehicle damage, though most small claims courts limit awards to $5,000-$10,000. The bigger challenge often comes after winning your case – collecting money from someone who may not have assets or insurance.

Pedestrian fault situations can work in your favor. If the pedestrian was jaywalking, intoxicated, or otherwise negligent, you might recover some or all of your vehicle damage costs.

Subrogation potential exists when the pedestrian has assets or insurance coverage. Your insurer might pursue the pedestrian’s homeowner’s insurance or personal assets to recover costs, though this process can take months or even years.

The reality is that lacking collision coverage puts you at significant financial risk. Even minor car damage from hitting pedestrian collisions can cost thousands in repairs, making collision coverage one of the most valuable protections you can carry.

Special Legal Considerations

When car damage from hitting pedestrian collisions occur, the legal landscape becomes more complex than typical fender-benders. Understanding the unique legal rules can mean the difference between a covered claim and thousands in out-of-pocket costs.

The law treats pedestrian collisions differently than other accidents, and these differences directly impact both your insurance coverage and potential legal liability.

Reverse onus laws create the biggest surprise for most drivers. In Ontario, Section 193(1) of the Ontario HTA reverse onus shifts the burden of proof to you as the driver. This means you’re presumed at fault unless you can prove otherwise – quite different from the “innocent until proven guilty” standard in criminal law.

This presumption affects your insurance claim in several ways. Your collision coverage still pays for vehicle repairs, but the at-fault determination impacts your future premiums. It also affects how aggressively your insurer pursues subrogation if the pedestrian was actually at fault.

Contributory negligence offers some balance to reverse onus laws. Even when you’re presumed at fault, pedestrians can share responsibility for the collision. Jaywalking pedestrians often bear 50% or more of the fault, significantly reducing the driver’s liability.

Intoxicated pedestrians often bear substantial fault, especially when they stumble into traffic unexpectedly. Distracted walking – pedestrians texting or wearing headphones – also contributes to fault allocation. Traffic signal violations by pedestrians crossing against red lights create strong defenses against presumed fault.

Hit-and-run penalties represent the most serious legal consequence drivers face. Leaving the scene of a pedestrian collision, even when you believe the pedestrian wasn’t seriously injured, triggers criminal charges with potential jail time. License suspension happens automatically in most jurisdictions, and insurance policy cancellation often follows.

The legal system treats hit-and-run as evidence of consciousness of guilt, making it nearly impossible to defend against both criminal charges and civil lawsuits.

Limitation periods create important deadlines for various actions. Insurance claims require 30-day notice to your insurer, with two years typically allowed for lawsuits. Criminal charges for serious offenses have no limitation period, while civil suits must be filed within two to six years depending on your jurisdiction.

Pedestrian vs Cyclist Impacts

Insurance companies treat pedestrian and cyclist collisions almost identically, but a few key differences affect your coverage and costs. Coverage parity means your collision coverage applies equally to both situations, and liability coverage uses the same limits and deductibles.

Bicycle property limits create one notable difference. High-end bicycles can cost $5,000 to $15,000 or more, potentially exceeding your property damage liability limits. Consider whether your property damage limits adequately cover expensive bicycle replacements.

Mandatory liability minimums of $200,000 apply to both pedestrian and cyclist injuries, but serious injuries often exceed these limits.

Rate Hikes After At-Fault Pedestrian Collision

Premium increases following pedestrian collisions depend on several factors, but understanding the timeline helps you plan financially. Surcharge timelines typically begin at your next renewal, continuing for three to six years depending on your insurer.

Severity factors matter significantly. Minor injuries result in smaller surcharges than serious injuries requiring hospitalization. Injury claims generally increase surcharges more than property-damage-only accidents.

Accident forgiveness programs offered by some insurers can eliminate rate increases for your first accident. Eligibility requirements typically include a clean driving record for several years before the collision.

Premium shopping becomes crucial after a pedestrian collision. Rate variations between insurers can be substantial, with some companies pricing pedestrian collision risk more favorably than others.

Frequently Asked Questions about Car Damage & Pedestrian Collisions

What information should I collect at the scene?

The moments after a pedestrian collision can feel overwhelming, but collecting the right information protects both your insurance claim and legal position.

Start with pedestrian identification – get their name, address, and phone number if they’re conscious and able to communicate. Don’t interrogate someone who’s injured, but basic contact information helps your insurer process the claim faster.

Witness details become incredibly valuable when fault disputes arise. Collect names, phone numbers, and ask each witness to briefly describe what they saw. Many people will help immediately after an accident but become harder to reach later.

Scene documentation should include photos of your vehicle damage from multiple angles, the pedestrian’s position, any skid marks, and traffic control devices like crosswalks or signals. Take wide shots showing the overall scene and close-ups of specific damage.

Don’t forget environmental factors that might have contributed to the collision. Note weather conditions, lighting (was it dusk or dark?), and road conditions.

Get police information including officer names and report numbers. If multiple officers respond, note who’s handling the investigation versus traffic control.

Does comprehensive insurance ever cover pedestrian collision damage?

This might be the most expensive misconception in auto insurance. Comprehensive coverage never pays for car damage from hitting pedestrian collisions, despite what its name suggests.

Drivers regularly assume their comprehensive coverage would handle collision repairs. The disappointment is real when they find their policy won’t pay for thousands in vehicle damage.

Comprehensive coverage includes theft and vandalism, weather damage like hail or flooding, falling objects, and animal strikes. Notice what’s missing? Any type of collision damage.

Comprehensive coverage excludes all collision damage – whether you hit a pedestrian, cyclist, another vehicle, or a fixed object like a tree. The insurance industry separates these coverage types for good reason.

Only collision coverage pays for vehicle damage in pedestrian collisions. This coverage is optional in most places, but it’s essential if you want protection for your vehicle repairs.

How long do I have to tell my insurer about the accident?

Time matters more than most drivers realize when reporting pedestrian collisions. Your insurance policy likely requires “prompt” or “immediate” notification, which insurers typically interpret as 24-48 hours for serious injury collisions and 30 days maximum for property damage only.

Before starting any repairs, most policies require authorization from your insurer. This isn’t just a formality – unauthorized repairs can void your coverage entirely.

Consequences of delayed reporting can be severe. Your claim might be denied for significant delays, evidence preservation becomes complicated, and your insurer’s ability to recover costs from other parties gets reduced.

Best practice is reporting collisions within 24 hours, even if damage appears minor. Hidden damage often shows up during detailed inspection, and what looks like a simple bumper dent might involve expensive sensor or structural repairs.

Conclusion

Dealing with car damage from hitting pedestrian collisions feels overwhelming, but understanding the basics helps you protect yourself and handle the aftermath properly. These crashes create unique challenges that are different from typical car accidents – from the way damage occurs to how insurance companies handle claims.

The most important things to remember: Always have collision coverage on your policy, document everything immediately at the scene, and understand that many places have laws that assume you’re at fault until proven otherwise. These three factors alone can save you thousands of dollars and major legal headaches.

Prevention beats everything else. The way to avoid pedestrian collision damage is to stay alert, especially in busy areas like shopping centers, schools, and tourist spots. Slow down in crosswalks, put your phone away, and remember that pedestrians don’t always follow traffic rules – especially visitors who might not know the area.

Document now, thank yourself later. Take photos, get witness information, and call police even if everyone seems fine. Physical evidence disappears fast, and what seems like minor damage often turns into major repairs once mechanics start looking closer.

Here in Orange County, we see more pedestrian accidents during busy tourist seasons when unfamiliar visitors are walking around attractions and beach areas. Local drivers know to expect the unexpected, but even careful drivers can find themselves in difficult situations.

When things get complicated, professional legal guidance makes a real difference. Insurance companies have teams of adjusters and lawyers working on their side – you deserve someone working on yours. Pedestrian Accident Lawyer in Orange County, CA services become particularly valuable when dealing with serious injuries or when fault gets disputed.

At Adam Krolikowski Law Firm, we’ve guided drivers through these complex situations for over 25 years. We handle cases that other attorneys may not take, and we understand how stressful it feels when you’re dealing with both vehicle damage and potential injury claims.

You don’t have to handle this alone. Whether you’re fighting with insurance companies about coverage, dealing with fault determination issues, or facing injury claims, knowing your rights and options protects both your wallet and your legal standing. The aftermath of a pedestrian collision can feel overwhelming, but with the right guidance, you can work through it successfully.

Contact Us

Practice Areas

Recent Articles

- « Previous

- 1

- 2

- 3