Why You Need a Property Accident Attorney for Your Orange County Claim

A property accident attorney is a legal professional who helps property owners get compensation when their home, vehicle, business, or personal belongings are damaged due to someone else’s negligence or an insured event. Whether you’re facing a denied insurance claim, a lowball settlement offer, or mounting repair costs after an accident in Orange County, CA, the right attorney can make a significant difference.

If you’re searching for a property accident attorney in Orange County, here’s what you need to know:

- When to Call an Attorney: You may need legal help if your property damage is over $10,000, your claim was denied or undervalued, liability is disputed, or you also have a personal injury.

- No-Cost Case Reviews: Most property accident attorneys in Orange County offer a Free Consultation.

- Contingency Fee Basis: You pay no fees unless your attorney wins compensation for you.

- Strict Deadlines: California law has a three-year time limit to file a property damage claim.

- Types of Cases: Common claims involve vehicle damage, home damage (fire, flood), business property damage, and insurance bad faith.

Property damage is incredibly stressful. Whether it’s a car totaled on the 405, a tree crashing into your Orange County home, or water damage from bad construction, the financial strain can be immense. Insurance companies often offer less than what’s needed for full repairs, even to loyal policyholders. With Orange County’s high property and vehicle values, claims can be substantial. Navigating insurance policies, California law, and adjusters who work for the insurer—not you—is a difficult battle.

That’s where a property accident attorney comes in.

This guide covers what you need to know about property damage claims in Orange County, California—from types of damage and insurance issues to your legal rights. We’ll explain the difference between property and personal injury claims, the risks of signing release forms, and what constitutes insurance “bad faith.”

Most importantly, you’ll learn when a Free Consultation with a knowledgeable Orange County property accident attorney can protect your rights and maximize your recovery.

Simple guide to property accident attorney terms:

Understanding the Landscape of Property Damage Claims in Orange County, California

Legally, property damage is harm to an object or real estate, like a car, home, or personal item. A property damage claim seeks compensation to repair or replace what was damaged, restoring it to its pre-incident condition.

In Orange County, claims often arise from:

- Negligence: Carelessness causing damage, like a distracted driver on the 5 Freeway or a contractor’s error.

- Vandalism: Intentional destruction or theft.

- Car Accidents: A frequent cause of vehicle damage. California requires drivers to have at least $5,000 in property damage liability coverage.

- Construction Defects: Faulty work leading to leaks, mold, or other issues.

- Fires & Flooding: Can be accidental, negligent, or from natural disasters.

- Falling Trees/Objects: A neighbor’s tree or construction debris causing damage.

- Premises Liability Incidents: Damage occurring on someone else’s poorly maintained property. You can explore more about premises liability cases.

A key distinction is between “Acts of Nature” and “Acts of Man.”

- Acts of Nature: Events beyond human control, like strong winds or earthquakes. According to the NOAA National Severe Storms Laboratory, high winds can damage structures. Standard policies may cover wind, but floods and earthquakes often require separate insurance.

- Acts of Man: Damage from human action or inaction, like car accidents or negligence. Here, the at-fault party or their insurer is usually responsible.

Claims generally fall into these categories:

- Home Damage: Affects your residence and other structures from fires, water damage, storms, or construction defects.

- Business Damage: Similar causes affect commercial properties. Business interruption insurance may cover lost income during repairs.

- Vehicle Damage: The most common claim, involving cars, trucks, and motorcycles after an accident.

Distinguishing Property Damage from Personal Injury in Orange County

It’s vital to distinguish between property damage and personal injury claims, even if they stem from the same incident.

| Feature | Property Damage Claims | Personal Injury Claims |

|---|---|---|

| Focus | Damage to physical property (vehicle, home, belongings) | Physical, emotional, and psychological harm to a person |

| Compensation | Repair/replacement costs, diminished value, rental costs | Medical bills, lost wages, pain and suffering, emotional distress |

| Evidence | Photos of damage, repair estimates, receipts, valuation guides | Medical records, doctor’s notes, therapy bills, wage statements |

| Release Forms | Often specific to property damage, but can be broader | Waives rights to further compensation for injuries |

This distinction is crucial when dealing with insurance companies. They might offer a quick property damage claim settlement and ask you to sign a release form. Be careful: signing a broad release for “all claims” could prevent you from getting compensation for any injuries. Always ensure a release is for property damage only. Our team can review these documents to protect all your rights.

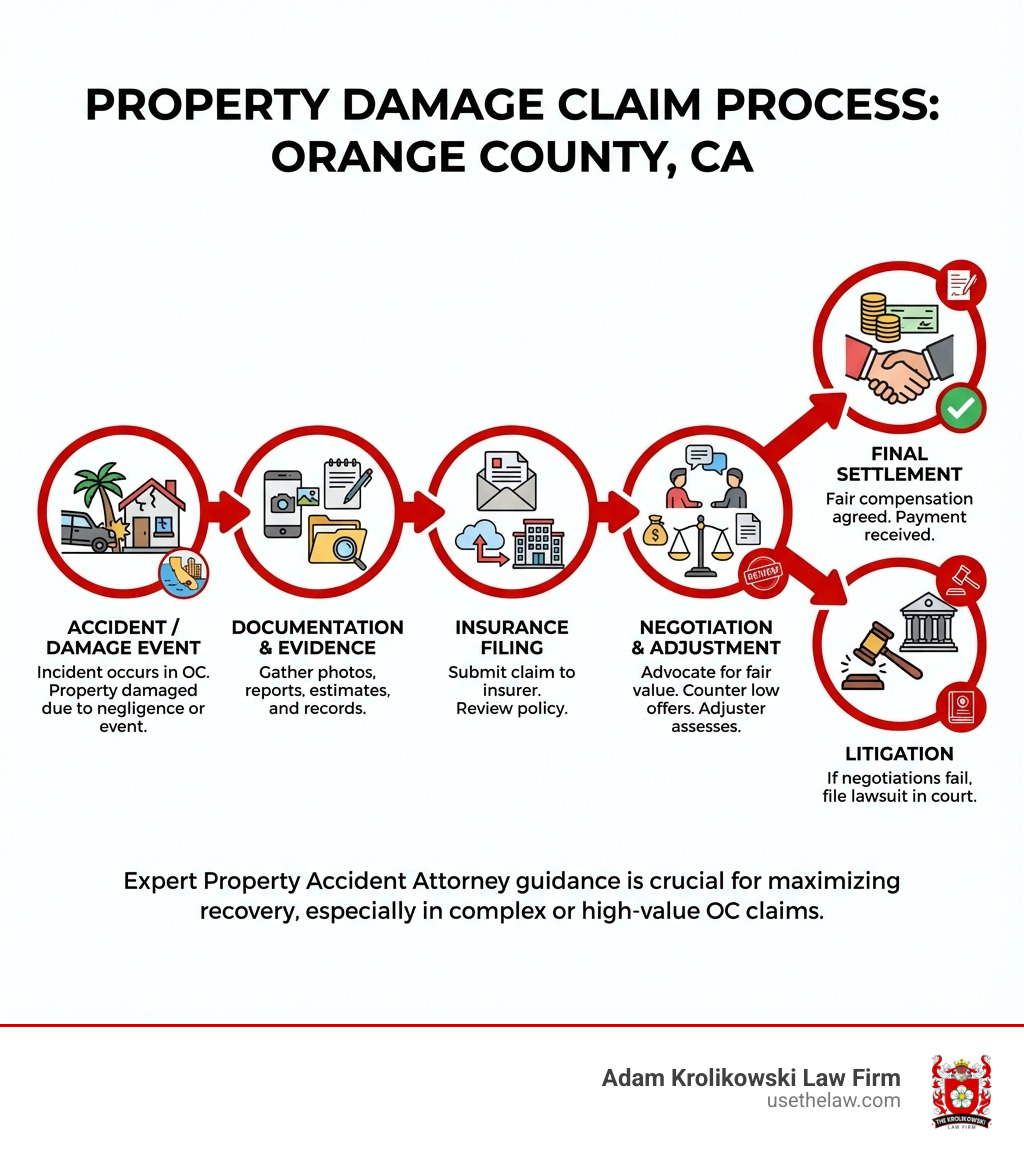

Navigating the Insurance Claim Maze in Orange County: A Step-by-Step Guide

After your property is damaged, you enter the insurance claim process. Insurance companies are businesses focused on profitability, so they may use tactics to minimize what they pay. These can include lowball offers, delays, or disputing liability. Insurance adjusters work for the insurer, not for you. As the Los Angeles Times noted, understanding your policy is critical, as insurers will use its language to their advantage.

Key Steps for Filing Your Property Damage Claim in Orange County

To effectively manage the claims process, follow these key steps:

- Document Everything Immediately: Take clear photos and videos of all damage. Note dates, times, and the value of damaged items. Don’t discard anything until the claim is settled.

- Notify Your Insurer Promptly: Report the damage to your insurance company as soon as possible to meet policy deadlines.

- File a Police Report: For theft, vandalism, or car accidents, a police report creates an official record for your claim.

- Prevent Further Damage: Take reasonable steps to mitigate more damage (e.g., cover a broken window) and keep receipts for any emergency repairs.

- Get Independent Estimates: Don’t just rely on the insurer’s estimate. Get multiple quotes from trusted, independent contractors in Orange County.

- Keep Meticulous Records: Maintain a paper trail of all communications. Note dates, times, names, and conversation summaries. This evidence is invaluable if disputes arise.

Crucial Documentation and Common Reasons for Denial in Orange County

A strong claim is built on solid documentation.

Crucial Documentation Includes:

- Proof of Loss: Detailed lists and photos/videos of damaged items with their estimated value.

- Receipts and Invoices: For damaged items, temporary repairs, and related costs like a rental car.

- Repair Estimates: Multiple, detailed estimates from reputable contractors.

- Correspondence: All communications with your insurance company.

- Police Reports: If applicable.

Common Reasons for Claim Denials:

- Lack of Coverage: The damage isn’t covered by your policy (e.g., flood damage without a flood policy).

- Missed Deadlines: Failure to report or submit documents on time.

- Insufficient Proof: Not enough evidence to support your claim.

- Policy Exclusions: Damage from excluded causes, like poor maintenance.

- Disputed Cause: The insurer claims the damage was pre-existing.

Be wary of the property damage release form. An insurer may ask you to sign this to settle your property claim. However, signing a release that includes “all claims” or “personal injury claims” could forfeit your right to compensation for injuries from the same accident. It is critical to ensure any release is for property damage only. We recommend having a property accident attorney review any such form before you sign.

Why You May Need a Property Accident Attorney in Orange County, CA

While you can handle simple claims alone, many situations benefit from the guidance of a property accident attorney in Orange County. Going head-to-head with large insurance companies is challenging.

You should consider contacting our firm for a Free Consultation if:

- Your claim is complex or involves significant damages.

- Liability is disputed by the at-fault party or their insurer.

- Your insurer is delaying payment, disputing your claim, or offering a low settlement.

- You suspect ‘bad faith’ insurance practices (explained below).

- The incident also caused personal injuries, complicating the claims.

- Your case is challenging, such as those involving negligent security cases, which our firm has handled for over 25 years.

Benefits of Hiring a Property Accident Attorney in Orange County, CA

Hiring a property accident attorney in Santa Ana or elsewhere in Orange County can greatly improve your claim’s outcome. Here’s how we can help:

- Leveling the Playing Field: We have the legal resources to stand up to large insurance companies.

- Policy Interpretation: We analyze your policy to identify all applicable coverages and challenge unfair interpretations.

- Accurate Damage Valuation: We work with independent appraisers and contractors to assess the true value of your damage.

- Negotiating Fair Settlements: We are skilled in negotiating with insurers and know how to counter lowball offers with strong evidence.

- Handling All Communication: We manage all calls and paperwork, freeing you from the stress.

- Litigation Support: If a fair settlement isn’t reached, we are prepared to take your case to court.

- Peace of Mind: Knowing a skilled legal team is advocating for you provides immense relief.

Understanding Vehicle Damage in Orange County: Total Loss and Diminished Value

When your vehicle is damaged in an Orange County accident, “total loss” and “diminished value” are key concepts.

Total Loss: Your vehicle is a “total loss” if repair costs exceed its actual cash value (ACV). The insurance company should pay you the vehicle’s ACV. We recommend using resources like Kelly Blue Book or the NADA guide to get an independent estimate of your car’s fair market value. We can help ensure the insurer’s valuation is fair and includes costs for a replacement vehicle.

Diminished Value: This is the drop in a vehicle’s market value after an accident, even with perfect repairs. A car with an accident history is worth less. There are two main types:

- Inherent Diminished Value: The automatic loss in value just for having been in an accident.

- Repair-Related Diminished Value: Additional loss from poor-quality repairs.

Proving diminished value can be difficult and often requires a professional appraisal. You can see how this is done in a Video Sample Expert Witness Diminished Value Report. We can help you build a strong case for diminished value to recover the true loss to your vehicle’s worth.

Taking Legal Action: Your Rights and Deadlines in Orange County, CA

Sometimes, negotiation fails, and legal action is necessary. This could mean suing the at-fault party or an insurance company for mishandling your claim.

To win a property damage lawsuit based on negligence, we must prove four elements:

- Duty: The defendant had a legal duty to use reasonable care (e.g., a driver’s duty to drive safely).

- Breach: The defendant breached that duty through their actions or inaction.

- Causation: The defendant’s breach directly caused your property damage.

- Damages: Your property was damaged, resulting in quantifiable financial losses.

Our team is well-versed in California-specific laws related to these elements.

What Constitutes Insurance ‘Bad Faith’ in Orange County?

Insurance companies have a legal duty of “good faith” to handle claims fairly. When they breach this duty, it’s known as “bad faith,” which is grounds for a lawsuit against the insurer.

Examples of bad faith in Orange County include:

- Unreasonable delays in investigating or paying a valid claim.

- Failing to conduct a prompt and thorough investigation.

- Misrepresenting your policy’s terms or coverage.

- Making a lowball offer without a reasonable basis.

- Refusing to defend you in a lawsuit covered by your policy.

- Denying a claim without a clear explanation.

If you suspect bad faith, contact us for a Free Consultation. You may be able to recover your original claim amount plus additional damages for the insurer’s actions.

California’s Statute of Limitations for Property Damage in Orange County

In California, you have a limited time to file a lawsuit for property damage. This “statute of limitations” is a strict legal deadline. You generally have three years from the date of the damage to file a claim for loss of personal property (vehicles, furniture) or real property (buildings, land). If you miss this deadline, you lose your right to pursue compensation.

It’s always best to act quickly while evidence is fresh. It’s also important to know that California requires drivers to carry a minimum of $5,000 in California for property damage liability. If damage exceeds this, the at-fault driver is personally liable for the rest. For more details on the legal process, see the state’s resources on California property damage cases.

Frequently Asked Questions about Orange County Property Accident Claims

We understand that navigating the aftermath of property damage can leave you with many questions. Here are some of the most common inquiries we receive from clients in Orange County:

How much does it cost to hire a property accident attorney in Orange County?

Most property accident attorneys work on a contingency fee basis. This means:

- No Upfront Fees: You pay nothing out of pocket to start your case.

- No Win, No Fee: We only get paid if we successfully recover compensation for you.

- Fees from the Settlement: Our fee is a percentage of the final settlement or award.

We offer a Free Consultation to discuss your case and our fee structure with no obligation.

Can I sue for property damage in small claims court in Orange County, California?

Yes, small claims court in Orange County is an option for simpler claims. In California, individuals can sue for up to $12,500.

- Pros: It’s simpler, faster, and cheaper. You don’t need a lawyer in the hearing.

- Cons: There’s a dollar limit. You must present your own case, and collecting a judgment can be difficult.

For complex cases or high-value damages, consulting a property accident attorney is often a better choice. We can help you weigh the options during a consultation.

What if the at-fault party is uninsured or underinsured in Orange County?

If the at-fault party lacks sufficient insurance, your options include:

- Your Own Insurance: Your collision coverage can pay for your vehicle’s damage, regardless of fault. Your uninsured/underinsured motorist (UIM) coverage might also apply.

- Sue the Individual: You can sue the at-fault person directly, but collecting a judgment can be hard if they have no assets.

- Consult an Attorney: We can help you explore all avenues for recovery. A property accident attorney can review your policy and assess the feasibility of a lawsuit to maximize your recovery.

Get the Right Guidance for Your Orange County Property Damage Claim

Dealing with property damage in Orange County is stressful. The process is filled with challenges, from lowball insurance offers and delays to confusing legal deadlines. Insurance companies aim to protect their bottom line, not yours, and you risk settling for less than you deserve.

At Adam Krolikowski Law Firm, we understand these challenges. With over 25 years of experience, we handle complex cases that other firms may not. We are dedicated to advocating for accident victims and employees in Orange County, including Santa Ana, to ensure they receive fair compensation.

Don’t let an insurance company dictate your recovery. If your property was damaged in Orange County, CA, and you’re struggling with your claim, we are here to help.

Contact us today for a Free Consultation. Let us put our knowledge to work for you and fight for the compensation you need to move forward. Your journey to recovery starts with the right legal guidance.

For more information, or if you’ve been involved in an incident requiring legal assistance, you can also learn how to contact an Orange County, CA lawyer for your slip and fall case.

Contact Us

Practice Areas

Recent Articles

- « Previous

- 1

- 2

- 3

- Next »